Investing in Stocks

More and more Filipinos are now learning and practicing investment as opposed to our culture of saving money in the bank, letting it sleep there. Recently, I started to appreciate investments. Some would invest for their future, some for their retirement and others for their family when in case something happens to them. As for me, I am a type of person who would like to save a little, take a risk in an investment but I need to enjoy the profit as soon as possible while my body is strong. I guess I'm not that afraid of the future :)

There are many ways of investing your money and one of the worthwhile investments available out there is stock trading. If you are a risk-taker, proactive and immersed in their investments, then stock trading is a good one.

Stocks is a type of security that signifies ownership in a corporation which in turn will give you a part of a corporation's assets and earnings. When you buy stocks, you basically become a shareholder.

I started investing in the stocks with a very small amount in 2009 when a colleague introduced it to me.

I was then a RANGE TRADER. Here, you buy stocks of a company at a certain price and sells it at a higher price after some time, anticipating that the trend will continue to go up. Without knowing indicators of stocks, I started investing my money and waited for it to grow. Unfortunately, due to lack of knowledge, I was actually wasting opportunities of earning that time. I sold my shares at a higher price but with a small profit.

Because of this, I made some research to increase my profit. From my readings, I learned PESO COST AVERAGING which is commonly recommended for beginners.

WHAT IS PESO COST AVERAGING?

Cost averaging is an investment strategy which will require you to periodically purchase securities at predetermined intervals and capital over a long period of time. You'll better understand it by an example.

HOW TO CONDUCT PESO COST AVERAGING?

First you need to find a broker. There is one in Session Rd (I'm from Baguio and its the nearest broker) or you can choose to open an account with an online broker (mine is bpi trade and colfinancial). Opening an account is like and as easy as opening a savings account in a bank.

Second, you need a good company to invest in, you may choose from one of the BLUE CHIPS (a company who is well established and financially sound). You can check on PSE's website to know which ones are the blue chips. For illustration purposes, let's say you chose company MOS (hypothetical).

Third, you need to determine how much to invest per month, let's say P5,000. Most experts say you should only invest 20% of your monthly income.

Fourth, decide how long and how often will you buy. One year is a good start, some choose longer time to increase their profit. Let's say you started today, will invest for one year and will purchase shares every month.

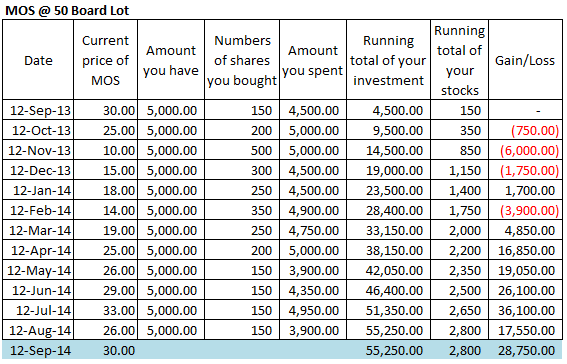

Sample computation:

Current price - is the price per share of a certain company that day. The higher the price the less number of shares you can buy with your money.

Number of shares you bought - notice that it is a multiple of 50, I assumed you are just buying by board lot every month.

Amount you spent - the cost of the board lot you bought at the prevailing price (look at column 2) or current price multiplied by the number of shares.

Running total of your investment - is the cumulative amount you already spent from first day up to the current day (or row in the table). From the table above, Column 6-first row: 4500 + 5000 (from Column 5-2nd row) = 9500 (Column 6-2nd row).

2800 shares x 30 pesos per share = 84,000.00 market value

There are many ways of investing your money and one of the worthwhile investments available out there is stock trading. If you are a risk-taker, proactive and immersed in their investments, then stock trading is a good one.

Stocks is a type of security that signifies ownership in a corporation which in turn will give you a part of a corporation's assets and earnings. When you buy stocks, you basically become a shareholder.

I started investing in the stocks with a very small amount in 2009 when a colleague introduced it to me.

I was then a RANGE TRADER. Here, you buy stocks of a company at a certain price and sells it at a higher price after some time, anticipating that the trend will continue to go up. Without knowing indicators of stocks, I started investing my money and waited for it to grow. Unfortunately, due to lack of knowledge, I was actually wasting opportunities of earning that time. I sold my shares at a higher price but with a small profit.

Because of this, I made some research to increase my profit. From my readings, I learned PESO COST AVERAGING which is commonly recommended for beginners.

WHAT IS PESO COST AVERAGING?

Cost averaging is an investment strategy which will require you to periodically purchase securities at predetermined intervals and capital over a long period of time. You'll better understand it by an example.

HOW TO CONDUCT PESO COST AVERAGING?

First you need to find a broker. There is one in Session Rd (I'm from Baguio and its the nearest broker) or you can choose to open an account with an online broker (mine is bpi trade and colfinancial). Opening an account is like and as easy as opening a savings account in a bank.

Second, you need a good company to invest in, you may choose from one of the BLUE CHIPS (a company who is well established and financially sound). You can check on PSE's website to know which ones are the blue chips. For illustration purposes, let's say you chose company MOS (hypothetical).

Third, you need to determine how much to invest per month, let's say P5,000. Most experts say you should only invest 20% of your monthly income.

Fourth, decide how long and how often will you buy. One year is a good start, some choose longer time to increase their profit. Let's say you started today, will invest for one year and will purchase shares every month.

Sample computation:

Board Lot - multiples of stocks you're allowed to buy/sell (you can also buy odd lot, as opposed to a board lot, but at a higher price). In this example, you can buy 50, 100, 150, and so forth

Date - the day you bought your shares, notice that I hypothetically scheduled it every 12th of the month.

Current price - is the price per share of a certain company that day. The higher the price the less number of shares you can buy with your money.

Number of shares you bought - notice that it is a multiple of 50, I assumed you are just buying by board lot every month.

Amount you spent - the cost of the board lot you bought at the prevailing price (look at column 2) or current price multiplied by the number of shares.

Running total of your investment - is the cumulative amount you already spent from first day up to the current day (or row in the table). From the table above, Column 6-first row: 4500 + 5000 (from Column 5-2nd row) = 9500 (Column 6-2nd row).

Running total of your stocks - the number of shares you already own up to the current day (or row in the table). From the table above, Column 7-first row: 150 + 200 (from Column 4-2nd row) = 350 (Column 7-2nd row).

Gain/Loss - multiply your total shares(column 7) that day and the prevailing price (column 2), then subtract the running total of money you invested (column 6). Notice that its negative (loss) if the price of MOS goes down, however you get to buy more stocks that day which is good since you intend to own as much stocks as you can as you continue to invest. The more shares you can acquire at a lower price the more shares you can sell at a higher price in the future.

After a year, if MOS is P30.00 per share and you own 2,800 shares, then you earn P28,700.00 when you decide to sell it.

2800 shares x 30 pesos per share = 84,000.00 market value

84,000 - 55,250 = 28,750.00 gain

Notice also that you still earn regardless if the market is down or up. Cost-Averaging does not require you to watch your stocks religiously, perfect for busy persons.

Happy trading!

Comments

Post a Comment